"Edmonton Homeowners Brace for 6.9% Property Tax Hike in 2026 - What's Next?"

Edmonton Buzz

Archives

"Edmonton Homeowners Brace for 6.9% Property Tax Hike in 2026 - What's Next?"

SIGN UP FOR OUR NEWSLETTER

Edmonton Lock-in: Property Taxes Set to Jump 6.9% in 2026 |

Four-Day Budget Marathon Concludes with Final Vote, Drawing Sharp Criticism from Dissenting Councillors and Residents Concerned About Affordability. |

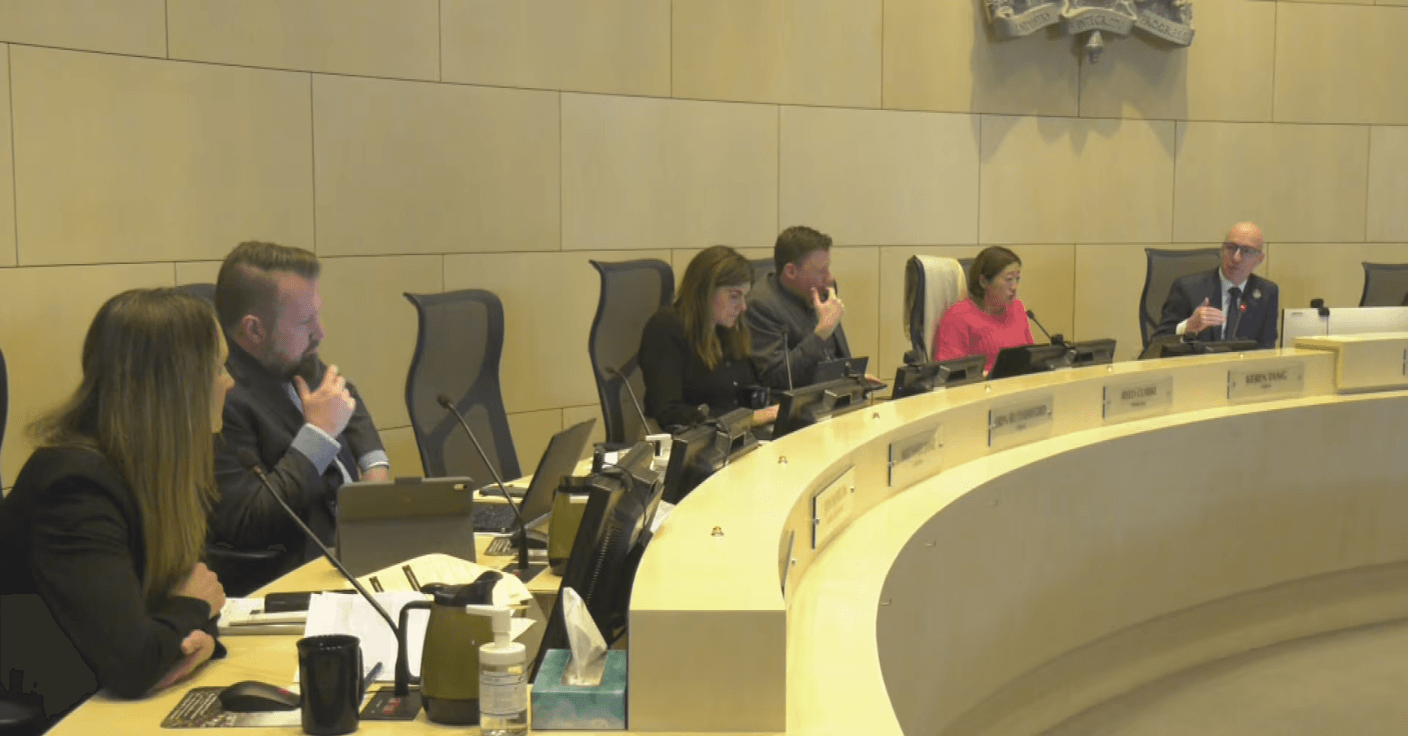

The four-day budget deliberation marathon at Edmonton City Hall concluded with a decision that, while perhaps necessary in the eyes of the majority, landed with the familiar, heavy thud of fiscal pain for residents and businesses. By a vote of 11-2, City Council approved the 2026 budget, locking in a 6.9 per cent property tax increase, the final adjustment in the city’s current four-year budget cycle. The number itself tells a story of rising costs and strained finances. What began as an expected 6.4 per cent increase, itself a significant figure climbed an additional half-percentage point during the intense budget debates, a direct reflection of Council’s last-minute funding decisions and the sheer difficulty of trimming essential services amid inflationary pressures. For the average Edmonton homeowner, this increase translates to an additional cost of approximately $245 next year, marking yet another steep hike following previous high annual increases. This decision was not made lightly. It has generated significant local conversation, split Council, and drawn immediate, sharp criticism from residents and business advocates alike, who view the increase as yet another blow to affordability in an already challenging economic environment.

The Anatomy of the Increase: Why 6.9%?To understand how the final tax levy settled at 6.9 per cent, one must look beneath the surface of the headline number into the structural budget variances that have plagued the City’s finances since the 2023-2026 budget was first approved in 2022.

City Manager Eddie Robar succinctly articulated the core problem: “It takes a lot of people, time and equipment to keep a city running, and all those things cost more now.” The main drivers pushing the cost of running Edmonton higher than initially forecasted include:

The Dissent: Frustration on the FloorThe final vote, though a substantial majority, was far from harmonious. The deep-seated frustration felt by some councillors and constituents was clearly articulated by the dissenting voices of Ward pihêsiwin Councillor Mike Elliott and Ward tastawiyiniwak Councillor Karen Principe, who were the only two to vote against the final budget. Councillor Principe, visibly upset following the decision, stated that she had been hoping to see a decrease, not another increase, and that she expected Council to make "tough decisions" and prioritize spending. She had motioned for several cuts, including delaying the demolition of the Argyll Velodrome and various transit system upgrades, which collectively amounted to nearly $29 million in potential savings. However, her motions were repeatedly defeated.

The sentiment among the dissenting members was that the Council had failed to grapple meaningfully with the structural spending problem, opting instead for a higher tax levy to cover new spending and existing deficits. Councillor Erin Rutherford, who ultimately voted in favour of the final budget, also put her colleagues "on notice," stating she could not continue to support year-over-year increases without a fundamental change in how the city budgets and prioritizes.

Community Reaction: A Blow to Affordability The public and business reaction was swift and critical, centering almost universally on the issue of affordability. For residents already struggling with high inflation, rising mortgage rates, and increased utility bills, a 6.9 per cent tax hike is a significant financial burden. Mayor Knack defended the necessity of the increase, stating that to go lower than the initial 6.4 per cent would have required draconian cuts to core services like transit, libraries, and recreation centres, reductions he argued would have made structural variances even worse. The Canadian Federation of Independent Business (CFIB) issued a particularly scathing statement, expressing deep disappointment. The CFIB argued that Council "needed to find efficiencies, and they left Edmontonians holding the bag instead." The statement highlighted a persistent inequity for businesses, who currently pay a property tax rate over three times higher than residents, accounting for nearly half (45%) of the city's property taxes despite making up only 22% of the property value. The CFIB argued that this dramatic increase, especially coming on the heels of the controversial Explore Edmonton funding, only worsens the sentiment that Edmonton is not a competitive or fair jurisdiction for small businesses.

Looking Ahead: The 2027-2030 Budget Challenge The 6.9 per cent increase finalizes the current four-year budget cycle. The reality, however, is that this adjustment merely kicks the proverbial can forward. The underlying challenges of inflation, growth, and structural variances remain.

Mayor Knack acknowledged this gravity, stating, “We need to really go through the next four-year budget and completely transform how we’re doing things.” The City's Chief Financial Officer warned Council that the city still needs to address an estimated $38 million in structural deficits heading into the new cycle. The debates over the 2026 budget served as a prologue to the much larger fiscal battle that awaits Council as they prepare to build the 2027-2030 budget. That process, which will begin with public engagement throughout 2026, will force a more comprehensive and perhaps painful re-evaluation of Edmonton’s service delivery model and financial sustainability.

The message is clear: Edmonton is choosing to pay for its existing services and key economic investments now, rather than deferring costs and service quality into the future. But the price, a 6.9 per cent property tax increase, has reinforced the growing sense of fiscal strain for everyone who calls the city home. |